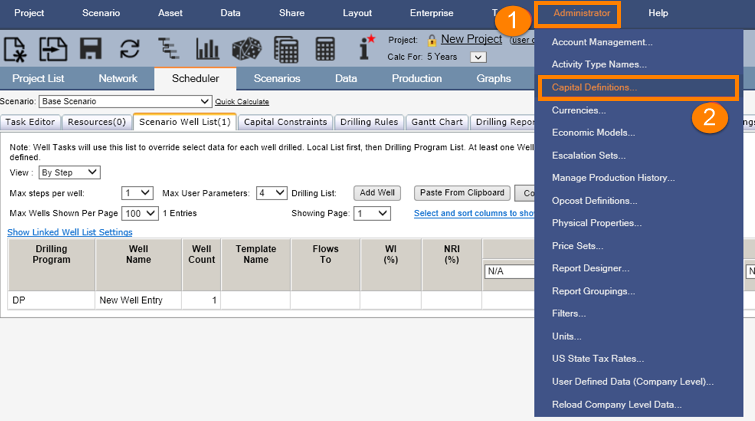

Capital cost definitions are customizable in Enersight. To change the capital definitions, go to "Administrator - Capital Definitions."

Click image to expand or minimize.

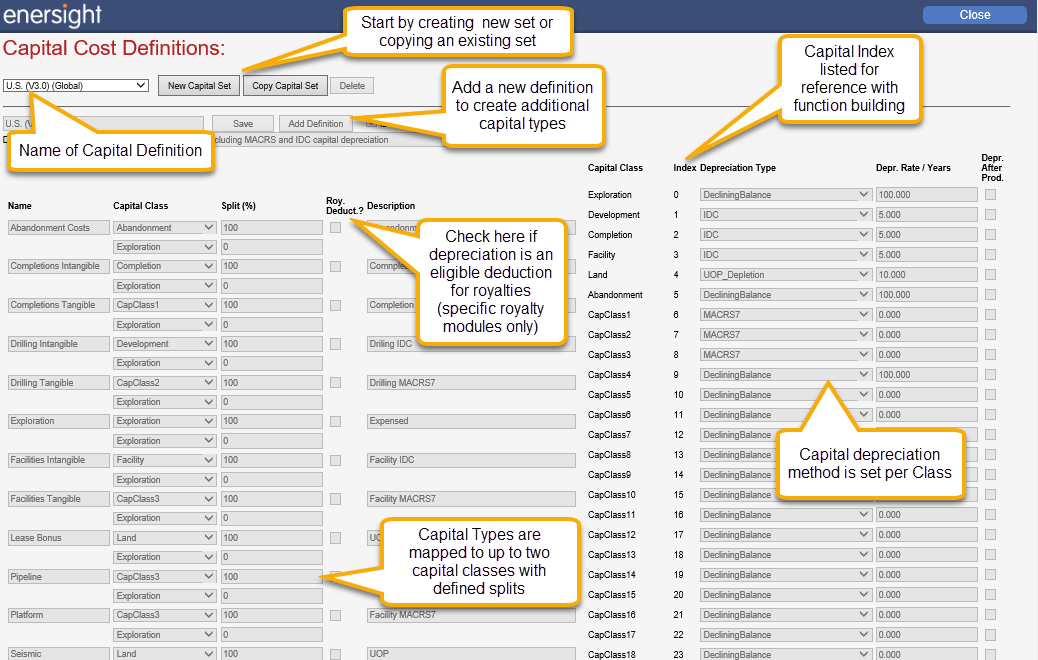

The following Capital Cost Definition screen is displayed:

Click image to expand or minimize.

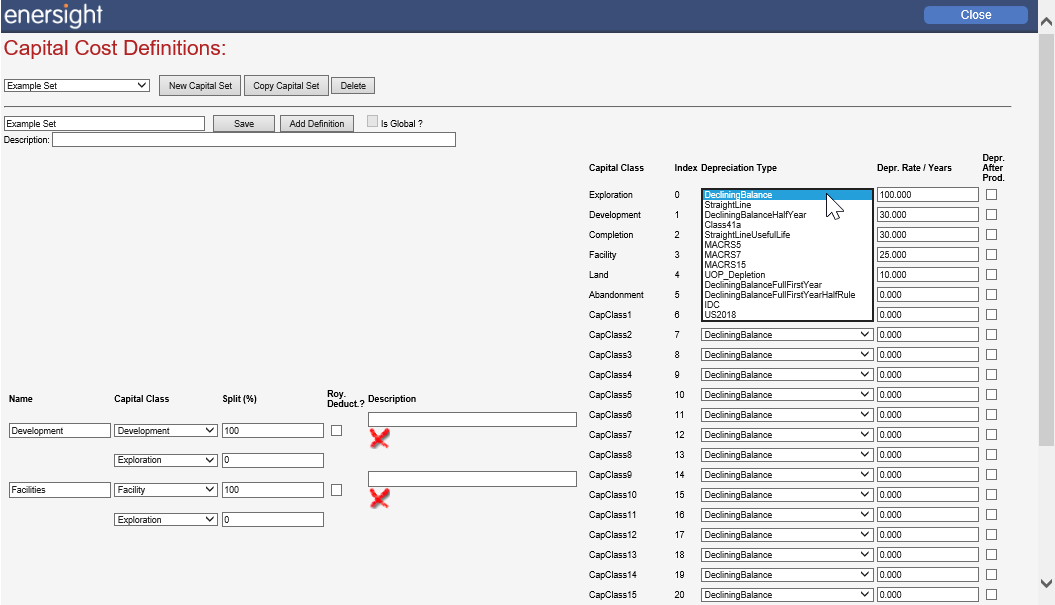

To change your Capital definition:

- Copy an existing set (or create a new record)

- Name the Capital set

- Click on "Add Definition" to create additional rows of capex

- Select the Depreciation category

- Specify whether or not it is an eligible royalty deduction

- Provide a description (optional)

- Save when you are done

- You must modify the economic model to link your new definitions to your economic models.

Click image to expand or minimize.

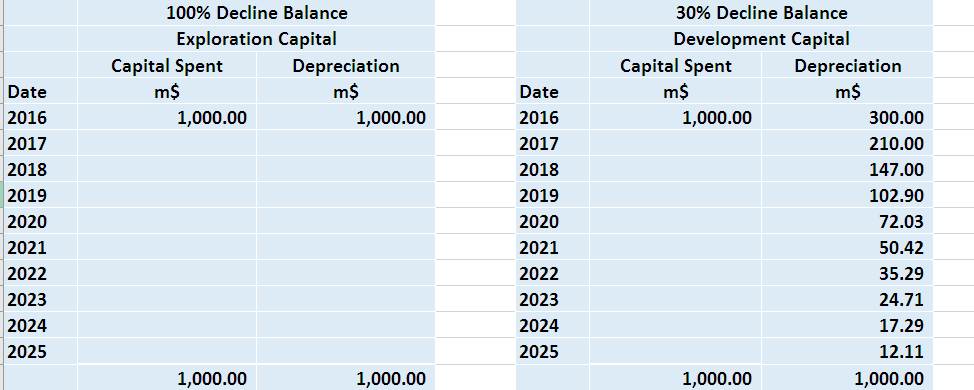

Declining Balance - Takes a constant percentage each year. E.g. 30% declining balance on $1,000 is $300 for the first year). The tables below show some examples for declining balance depreciation.

Click image to expand or minimize.

Straight Line - Divides the capital by the number of years and claims the same amount each year. Eg 5 year straight line is $200/year (20%) on $1,000.

Class 41a - Alberta heavy oil Capital Cost Allowance (CCA) which allows for capital which is a minimum of 5% of current revenue (such as a major facility upgrade) to be expensed (100% depreciation) in the year that it is spent.

Straight Line Useful Life - This is a straight line method (see above), but instead of the useful life being fixed by the capital definition, it is set by the user in the case.

MACRS 5, MACRS 7- Modified Accelerated Cost Recovery System (MACRS) Double Declining balance switching to straight line. MACRS 5 switches to straight line in year 4, while MACRS 7 switches to straight line in year 5. The double declining balance is twice that of the equivalent straight line method. For 5 years that is 40% and for 7 years, 28.57. The 1/2-year rule is used in the first year and last year.

The depreciation schedules are as follows:

Year | MACRS 5 | MACRS 7 |

|---|---|---|

1 | 20.0% | 14.3% |

2 | 32.0% | 24.5% |

3 | 19.2% | 17.5% |

4 | 11.5% | 12.5% |

5 | 11.5% | 8.9% |

6 | 5.8% | 8.9% |

7 |

| 8.9% |

8 |

| 4.5% |

Total | 100.0% | 100.0% |

US2018 – A modified version of MACRS7 to match USA tax changes enacted within 2018 which included allocation of 100% of capital to Tangible Expenses till 2022 then stepped down allocation per year. Refer to this spreadsheet for interpreted calculation method.

UOP Depletion - Unit of Production (UOP). The depreciation is equal to the Opening depreciation balance times the yearly production divided by the remaining reserves at the start of the year.

IDC - Is 70% expense (100% depreciation in the first year) and the balance as 5-year straight line with a 1/2-year rule. The resulting schedule is as follows:

Year | IDC |

|---|---|

1 | 73.0% |

2 | 6.0% |

3 | 6.0% |

4 | 6.0% |

5 | 6.0% |

6 | 3.0% |

Total | 100.0% |

Half Year Rule - When the half year rule is used, the depreciation is limited to 50% of the yearly total in the first year.

model which Enersight can quickly create for you. Please contact Enersight support for more information.